XRP’s price reached a standstill at $0.51 on May 2, 2024, and despite experiencing fluctuations in the market over the past month, derivatives traders are displaying impressive resilience.

XRP’s price has been outperforming the market, despite enduring volatile swings in April that resulted in a 24% decline for the month. However, a closer examination of recent market activity reveals that XRP has actually outperformed Bitcoin, Ethereum, and the broader crypto market in the last 10 days.

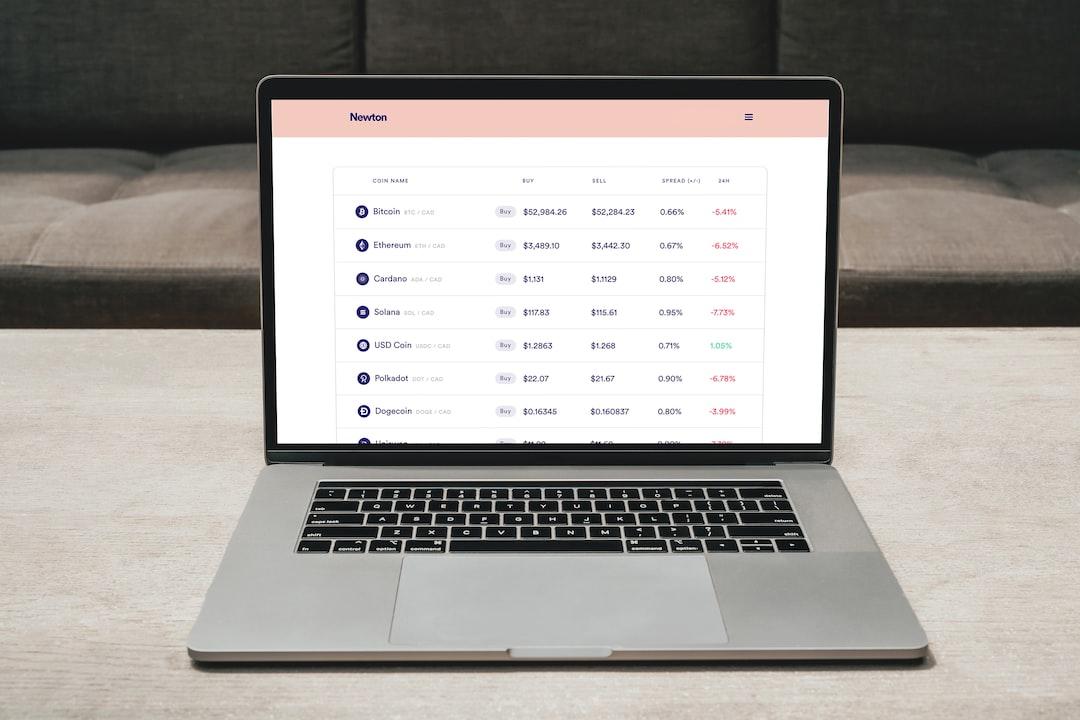

Analyzing the market data depicted above, XRP’s price has declined by 10.1% since April 23. In contrast, the TOTAL CRYPTOCAP chart, which tracks the market capitalization of all listed crypto assets, shows a decline of 13.3% during the same 10-day timeframe between April 23 and May 2. This suggests that XRP’s price has outperformed the overall crypto markets by a margin of 3% in the past week.

Looking beyond the price charts, recent trends in the derivatives markets indicate that optimistic speculative traders are behind XRP’s resilient price performance compared to the broader crypto sector. Coinglass’ Open Interest chart tracks real-time fluctuations in the value of active futures contracts opened for a specific cryptocurrency asset.

On April 23, XRP’s open interest was valued at $562.3 million. By the time of publication on May 2, that figure had declined to $540.2 million, representing a 4% decrease of $22 million. Simultaneously, XRP’s price dropped by 10.1% during the same 10-day period.

When open interest remains steady with smaller declines compared to price, strategic investors may interpret it as a bullish signal. This suggests that despite the price drop, market participants are maintaining their positions and making hedge purchases rather than exiting. This continued interest in XRP indicates underlying confidence among existing holders. Additionally, the relatively stable open interest may indicate fatigue among sellers, which often precedes a rebound phase.

Based on the analyzed market data, a stable open interest could keep XRP’s price above $0.50 in the coming days. However, the possibility of a definitive rebound towards $0.60 relies heavily on demand returning to the broader crypto markets. On a positive note, the Bollinger bands technical indicator shows that XRP is currently trading just above the 20-day SMA at $0.51, giving bulls the advantage in the short term.

If the bulls continue to extend the recovery phase, they may encounter significant resistance at $0.55, as indicated by the upper-limit Bollinger band indicator. Conversely, the bears could take control if XRP loses the psychological support at $0.45. However, this outcome seems unlikely in the near term, considering the steady open interest and the potential buy-wall at the $0.48 level.

It is important to note that this content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.